Bonus tax calculator,online Bonus tax calculator

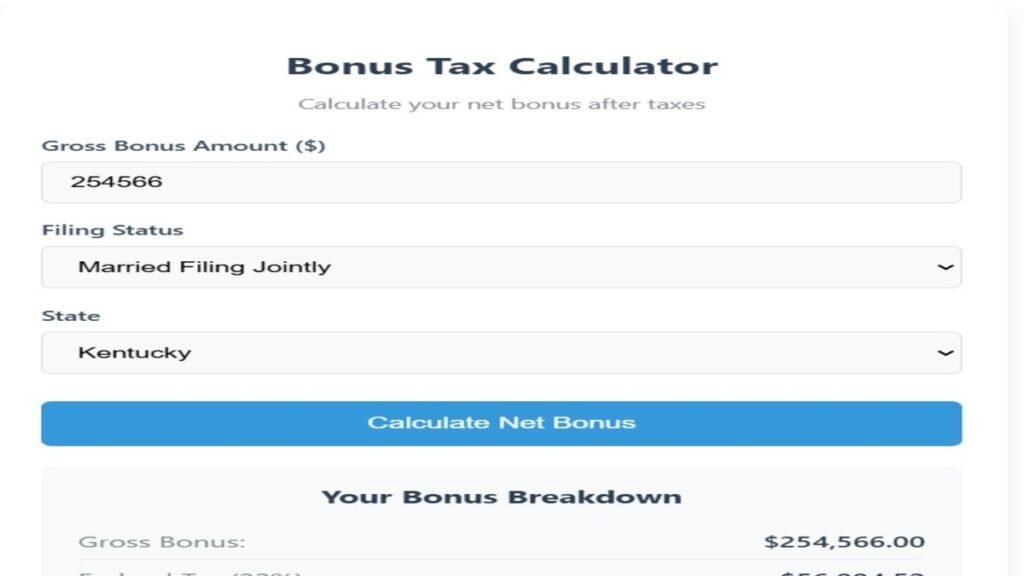

Bonus Tax Calculator

Calculate your net bonus after taxes

Note: This calculator provides estimates only. The IRS typically withholds 22% federal tax on bonuses. State taxes vary. Consult a tax professional for exact calculations.

Ultimate Bonus Tax Calculator: Estimate Your Net Bonus After Taxes

Introduction

Receiving a bonus is exciting—it’s a reward for your hard work and dedication. However, before you start planning how to spend it, you need to understand how much will actually land in your bank account after taxes. Bonuses are taxed differently than regular income, often at a higher rate, which can lead to surprises when you see your paycheck.

Bonus Tax Calculator is a free, easy-to-use tool that helps you estimate your net bonus after federal, state, and payroll taxes. Whether you’re an employee receiving an annual bonus, a salesperson getting a commission, or an employer calculating withholdings, this calculator provides accurate estimates to help you plan better.

How Bonuses Are Taxed in the U.S.

Bonuses are considered supplemental wages by the IRS, meaning they are subject to different withholding rules than regular income. There are two main methods employers use to tax bonuses:

1. Percentage Method (Flat 22% Federal Tax for Bonuses Under $1 Million)

- The IRS mandates a 22% federal tax withholding on bonuses under $1 million.

- If your bonus exceeds $1 million, the portion above that is taxed at 37%.

2. Aggregate Method (Combined with Regular Paycheck)

- Some employers add the bonus to your regular paycheck and withhold taxes based on your W-4 withholdings.

- This can sometimes result in a higher tax rate if the bonus pushes you into a higher tax bracket.

Additional Taxes on Bonuses

Besides federal taxes, your bonus may also be subject to:

- State income tax (varies by state)

- Social Security tax (6.2%)

- Medicare tax (1.45%)

How to Use Our Bonus Tax Calculator

Bonus Tax Calculator is designed for simplicity and accuracy. Follow these steps:

- Enter Your Gross Bonus Amount

- Input the total bonus amount before any deductions.

- Select Your Filing Status

- Choose between Single, Married Filing Jointly, or Head of Household.

- Choose Your State

- State taxes vary, so select your location for precise calculations.

- Click "Calculate Net Bonus"

- Instantly see a detailed breakdown of your deductions and net take-home pay.

Detailed Tax Breakdown: What You’ll See

After calculating, the tool provides a clear summary of all deductions:

| Tax Component | Rate | Amount Deducted |

|---|---|---|

| Gross Bonus | - | $10,000 |

| Federal Tax (22%) | 22% | $2,200 |

| State Tax (varies) | 5% (example) | $500 |

| Social Security (6.2%) | 6.2% | $620 |

| Medicare (1.45%) | 1.45% | $145 |

| Net Bonus After Taxes | - | $6,535 |

Why Use Our Bonus Tax Calculator?

1. Accurate & Reliable Estimates

- Uses IRS-mandated tax rates for bonuses.

- Includes state-specific tax calculations.

2. No Hidden Fees or Registration

- 100% free—no signup required.

- No ads or spam—just a straightforward tool.

3. Helps with Financial Planning

- Know exactly how much you’ll receive before payday.

- Plan for savings, investments, or big purchases.

4. Employer & Employee Friendly

- Useful for HR teams calculating withholdings.

- Helps employees avoid tax surprises.

State-Specific Bonus Tax Rules

Some states have no income tax, while others tax bonuses at different rates. Here’s a quick overview:

| State | Income Tax on Bonuses |

|---|---|

| Texas | 0% (No state tax) |

| Florida | 0% (No state tax) |

| California | Up to 13.3% |

| New York | Up to 10.9% |

| Pennsylvania | Flat 3.07% |

Bonus tax calculator

Advanced Features of Our Bonus Tax Calculator

1. Real-Time Calculations

- Adjust numbers and see instant updates without refreshing.

2. Multiple Filing Statuses

- Accounts for Single, Married, and Head of Household tax brackets.

3. Detailed Deduction Breakdown

- Shows federal, state, Social Security, and Medicare deductions separately.

4. Mobile-Friendly Design

- Works seamlessly on phones, tablets, and desktops.

5. No Personal Data Required

- No sensitive information needed—just enter your bonus amount.

Bonus tax calculator trust & Security: Why You Can Rely on Our Tool

1. No Data Collection – We don’t store your inputs.

2. Up-to-Date Tax Rates – Regularly reviewed for accuracy.

3. Transparent Calculations – Clear breakdown of every deduction.

4. No Ads or Upsells – Pure, unbiased calculations.