Interest calculator,free online interest calculator, in the world digitalizes world so all client should be shorted so put your amount and calculate the finalized result

Interest Calculator

Table of Contents

- What is an Interest Calculator?

- Why Use an Interest Calculator?

- Types of Interest: Simple vs. Compound

- Key Features of a Modern Interest Calculator

- Trust & Security Guide

- How to Use an Interest Calculator (Step-by-Step)

- Advanced Features for Precision Calculations

- Conclusion: Take Control of Your Financial Future

1. What is an Interest Calculator?

An interest calculator is a digital tool that helps individuals and businesses calculate the interest accrued on savings, investments, or loans over time. By inputting variables like principal amount, interest rate, and time period, users can instantly visualize how interest impacts their finances. This tool eliminates manual errors, saves time, and provides clarity for better financial planning.

Why It Matters:

- Predict loan repayment totals

- Estimate investment growth

- Compare financial products (e.g., savings accounts, loans)

2. Why Use an Interest Calculator?

Whether you’re saving for retirement, paying off student loans, or investing in a business, understanding interest is critical.

Benefits Include:

Accuracy: Avoid manual calculation errors.

Speed: Get results in seconds.

Transparency: Break down complex interest formulas into digestible insights.

Informed Decisions: Compare scenarios (e.g., “What if I pay off my loan faster?”).

3. Types of Interest: Simple vs. Compound

Simple Interest

Simple interest is calculated only on the initial principal. It’s common in short-term loans or investments.

Formula:Simple Interest=P×R×TSimple Interest=P×R×T

(P = Principal, R = Annual Rate, T = Time in Years)

Example:

A $10,000 loan at 5% annual interest for 3 years = $1,500 interest.

Compound Interest

Compound interest earns “interest on interest,” leading to exponential growth. It’s used in savings accounts, mortgages, and long-term investments.

Formula:Compound Interest=P×(1+Rn)nT−PCompound Interest=P×(1+nR)nT−P

(n = Compounding Frequency per Year)

Example:

$10,000 invested at 5% annually compounded monthly for 3 years = $1,616.52 interest.

Comparison Table:

| Factor | Simple Interest | Compound Interest |

|---|---|---|

| Growth | Linear | Exponential |

| Best For | Short-term loans | Long-term investments |

| Earnings Potential | Lower | Higher |

4. Key Features of a Modern Interest Calculator

Today’s tools go beyond basic calculations. Look for these features:

- Dual Modes: Toggle between simple and compound interest.

- Flexible Time Units: Calculate in years, months, or days.

- Currency Support: Handle multiple currencies (USD, EUR, GBP).

- Graphical Reports: Visualize growth with interactive charts.

- Mobile-Friendly Design: Use on any device.

- Save & Export: Download results as PDF/CSV.

5. Trust & Security Guide

Why Trust Our Interest Calculator?

No Data Storage: We don’t collect or save your financial details.

Bank-Grade Encryption: SSL-protected calculations.

Transparent Formulas: Open-source algorithms for verification.

Regular Audits: Updated for accuracy with latest financial standards.

User Testimonials:

“This calculator helped me save $200/month on my mortgage!” – Sarah T.

“Finally, a tool that explains compound interest clearly!” – Raj P.

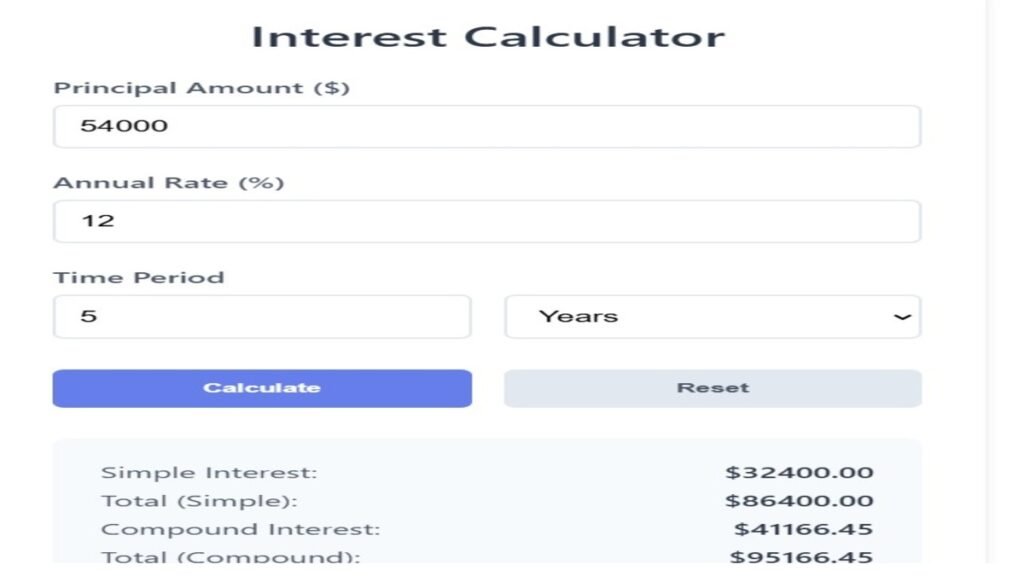

6. How to Use an Interest Calculator (Step-by-Step)

- Enter Principal Amount: Start with your initial investment or loan.

- Input Interest Rate: Annual percentage rate (APR).

- Select Time Period: Choose years, months, or days.

- Choose Interest Type: Simple or compound.

- Calculate: Instantly view interest earned/owed and total amount.

Use the “Compare” feature to test different rates or timeframes.

7. Advanced Features for Precision Calculations

a) Compounding Frequency Adjustments

Most tools let you customize compounding intervals:

- Annual

- Quarterly

- Monthly

- Daily

Impact Example:

$10,000 at 5% for 5 years:

- Annual compounding: $12,762.82

- Monthly compounding: $12,833.59

b) Tax & Inflation Adjustments

Advanced calculators factor in:

- Tax Rates: Deduct taxes from interest earnings.

- Inflation: Adjust results for purchasing power changes.

c) Amortization Schedules

For loans, view:

- Monthly payment breakdowns

- Principal vs. interest allocation

- Remaining balance over time