death duty calculator use our free Death Duty Calculator to quickly estimate inheritance tax (IHT) liability on an estate. Calculate tax due, taxable estate value, and net inheritance with accurate results. No sign-up required

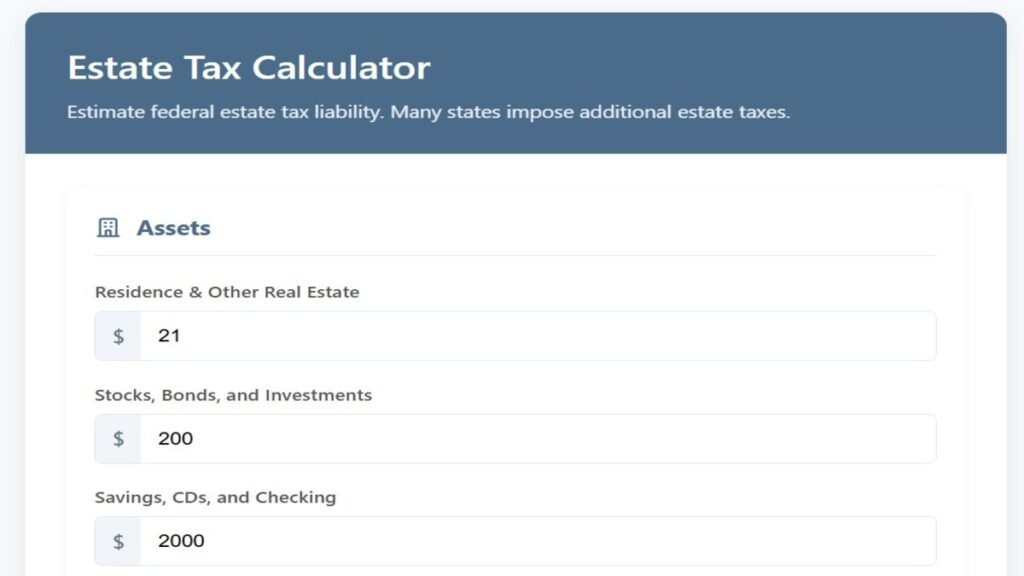

Estate Tax Calculator

Estimate federal estate tax liability. Many states impose additional estate taxes.

Assets

Liabilities & Deductions

U.S. Estate and Gift Tax Guide: Exemptions, Rates, and Strategies (2024-2025)

death duty calculator understanding Estate and Gift Taxes in the U.S.

death duty calculator estate and gift taxes are federal levies imposed on wealth transfers, either during a person’s lifetime (gift tax) or after death (estate tax). Proper planning can help minimize tax liabilities and maximize wealth preservation for heirs.

Federal Estate and Gift Tax Exemptions & Rates (2001-2025)

| Year | Lifetime Exemption | Tax Rate |

|---|---|---|

| 2001 | $675,000 | 55% |

| 2002 | $1 million | 50% |

| 2003 | $1 million | 49% |

| 2004 | $1.5 million | 48% |

| 2005 | $1.5 million | 47% |

| 2006 | $2 million | 46% |

| 2007 | $2 million | 45% |

| 2008 | $2 million | 45% |

| 2009 | $3.5 million | 45% |

| 2010 | Repealed | 0% |

| 2011 | $5 million | 35% |

| 2012 | $5.12 million | 35% |

| 2013 | $5.25 million | 40% |

| 2014 | $5.34 million | 40% |

| 2015 | $5.43 million | 40% |

| 2016 | $5.45 million | 40% |

| 2017 | $5.49 million | 40% |

| 2018 | $11.18 million | 40% |

| 2019 | $11.4 million | 40% |

| 2020 | $11.58 million | 40% |

| 2021 | $11.7 million | 40% |

| 2022 | $12.06 million | 40% |

| 2023 | $12.92 million | 40% |

| 2024 | $13.61 million | 40% |

| 2025 | $13.99 million | 40% |

Key Differences: Estate Tax vs. Inheritance Tax

Estate Tax

- Imposed on the total value of a deceased person’s estate before distribution.

- Federal exemption for 2024: $13.61 million per individual (double for married couples).

- Only amounts above the exemption threshold are taxed at 40%.

- No tax on assets transferred to a surviving spouse (marital deduction).

Inheritance Tax

- Paid by heirs receiving assets (not the estate itself).

- No federal inheritance tax, but some states impose it (e.g., Pennsylvania, New Jersey).

- Tax rates vary based on heir’s relationship to the deceased (spouses/children often exempt).

How to Reduce Estate Taxes Legally

death duty calculator

1. death duty calculator annual Gift Tax Exclusion (2025: $18,000 per recipient)

- Gifts below this limit are tax-free and do not count toward lifetime exemption.

- Exempt gifts: Charitable donations, tuition/medical payments (paid directly), spousal transfers.

2. Irrevocable Trusts

- Removes assets from taxable estate while allowing controlled distributions.

- Living trusts avoid probate, while testamentary trusts activate after death.

3. Charitable Donations

- Unlimited tax-free gifts to qualified 501(c)(3) organizations.

4. Spousal Transfers

- Unlimited tax-free transfers between spouses (must be U.S. citizens).

5. State Tax Planning

- 19 states + D.C. levy estate/inheritance taxes. Relocating can reduce liability.

death duty calculator estate Planning Checklist

✅ Inventory Assets (real estate, investments, insurance, businesses).

✅ Create a Will (ensures asset distribution per your wishes).

✅ Establish Trusts (avoids probate, reduces taxes).

✅ Assign Power of Attorney (for financial/medical decisions).

✅ Consult a Professional (estate attorneys, tax advisors).

Why Estate Planning Matters

- Avoids probate delays and unnecessary court fees.

- Protects minor children by assigning guardianship.

- Minimizes tax burdens for heirs.

- Ensures wealth transfer aligns with your wishes.